Lessons from Ramp, one of the fastest growing startups in history

How they earned a $22.5 billion valuation in less than a decade

✨ Hey there this is a free edition of next play’s newsletter, where we share under-the-radar opportunities to help you figure out what’s next in your journey.

The startup world is full of noise. There are headlines everywhere—”AI company raises monster round!”—but there are very few quality, in-depth analyses you can really trust to dig into the details.

The details can be useful for many reasons—one of the common themes that we regularly find fascinating (and hope you do too!) is trying to learn and unpack what is really going on at this outlier-ish startup, and what is driving their success? (This exercise can be useful for many reasons—informing your job search, helping you ideate new ideas, and more)

And that’s why we were excited to work with Wouter Teunissen on this (extremely detailed!) unpacking of one of the most exciting startups of the past decade.

Wouter is a student of the game of startups (and also recently launched his new newsletter The Biography Brief, a weekly email giving you lessons, stories and frameworks from the modern world class founders).

Below, you’ll find Wouter’s words covering the story of Ramp. It should be a useful reference point as you’re figuring out what’s next - as inspiration for vetting the new opportunities in front of you (whether that be starting a new job at a startup, leveling up at your current company, or perhaps even starting your own).

$2 billion saved, a $22.5B valuation, and 40,000 customers. In only 6 years.

Ramp’s Co-Founder & CEO, Eric Glyman is building one of the fastest-growing companies ever.

The 3 takeaways you will learn (and can steal) today are:

Creating a product so good – 99.93% of people who try it, stay customers.

How to create a team that ships 10x faster by understanding your trade-offs

How to differentiate your product so you can you leapfrog your competitors

There’s a lot to learn from Eric’s founder story (Over 37 pages of research and a 120-minute podcast, to be exact).

But I'm going to be distilling that into this newsletter for you. So how did Eric manage to build a $22B business? And what ideas and lessons can we learn from the Ramp story?

1. How to create a product so good – 99.93% of people who try it, stay customers.

Last year, 12,059 customers signed up for Ramp, only 8 decided Ramp was not for them.

Don't just capture value, create it. Lots of it.

Ramp saves companies 5% of their entire spend on average. When your entire business model is revolving around saving customers money, and maximising the value you provide for them – you’re going to create unmatched loyalty.

Often in business, as Charlie Munger said, “the winning system almost goes ridiculously far in maximising and/or minimising one or a few variables”.

If the variables you’re minimising are cost of service, and maximising money-kept, to a ridiculous level. There’s a good chance your customers are going to hang around.

In Eric’s first job at Express, a discount retail store in Vegas, he would watch families buy clothes on "sale" - then see prices drop 25% only days later.

Every customer felt like they were getting a deal, but the house always won.

Eric flipped the model:

At Paribus: Saved consumers money they were losing on purchases

At Ramp: Built a credit card that actively helps reduce spending

By focusing on creating value, you can make it so that BOTH the customer and you win. As Henry Ford said, “Money comes naturally as a result of service”.

Eric has said that; “ great businesses often start by being really curious about people’s problems, and how you can solve them…. Not with ‘what are the new breakthrough technologies and how do I apply that’”.

This is what happened at Paribus, Eric's first business. In 2013, Eric and a group of friends had just booked a trip. Flights locked, plans made, the excitement was building. But the next day, a friend decided to join and needed to book the same flight. When Eric went to check the prices, he noticed something odd.

The ticket that had cost him $100 just 12 hours earlier was now going for significantly less.

At first, Eric thought it had to be a glitch. He refreshed the page. Same result.

A $100 difference. And that’s when it hit him. Eric immediately contacted the company again so that they would honor the new prices.

“Before we knew it, we had $1,000 back between the whole group,” Eric recalled. “I just sat there and said, ‘You know, I wish there was some software service that would have told me that this change was out there.’”

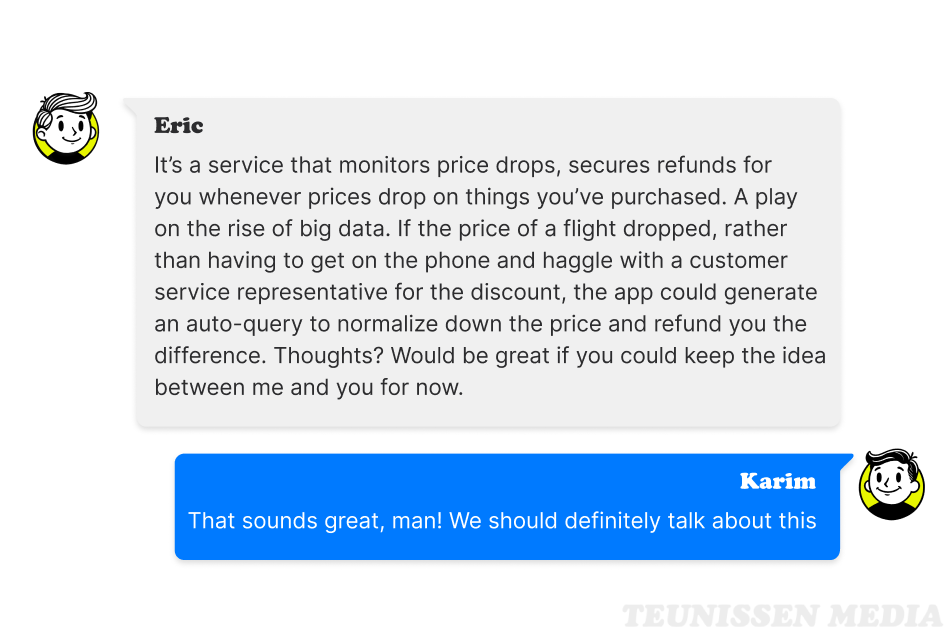

That thought didn’t stay in Eric’s head for long. Less than a day later, he fired off an email to Karim Atiyeh. The subject: a new idea.

The idea was simple: figure out when the prices of items you already bought dropped, and then automatically get you a refund. “We tracked the prices of the items you bought from your inbox,” Karim explained. “And we automatically reached out to stores on your behalf to get you a refund whenever the price drops, or if you missed a coupon, or if you missed the discount.”

This is very similar to the ethos at Ramp – aligning the incentives of the business to those of the customers: Maximise the savings of your customers, and minimizing their time spent doing so.

So what does this mean for you?

Every business says "win-win" but their incentives say otherwise.

When you align your success with that of your customers, magic happens: they never leave.

"For businesses, a dollar saved is 100x better than a reward point earned."

- Eric Glyman

2. How to ship product 10x faster without any trade-offs

What underlying decision making processes allow Ramp to move so fast?

Often you have a trade-off between speed-and-quality. So how can you move fast without sacrificing quality?

It starts by understanding your customer’s problems, and the products being built that serve them. Knowing this is important because it allows you to figure out what parts of the product need to be optimised for speed, and what needs to be optimised for quality.

For some products, you can iterate fast to the final solution and recover quickly. For other decisions, like changing an interest rate or moving money around there is a much higher ‘cost of mistake’.

The decision to change an interest rate or change the colour of a button should not have the same level of scrutiny in a decision making process.

Knowing where parts of your business fall into an acceptable level of risk helps you move quicker by separating your product/features into different buckets as opposed to pushing a one-size fits all approach on your entire company.

Lots of companies and financial services have this one-size fits all process that reduces the average time to ship features.

Before starting Ramp, Eric Glyman (and Karim Atiyeh) founded Paribus which was Acquired by Capital One.

At Capital One, when Eric worked there after the Paribus acquisition, the framework for most decisions was over-index on quality at the cost of shipping fast. This was the case in all decisions.

When Capital One’s CEO shared a story about ordering hockey gloves for his grandson on Amazon. The gloves, which were supposed to arrive before the weekend, didn’t show up until Monday – which was after the hockey game had already happened.

Curious if Amazon had a refund policy for late shipments, the CEO asked Eric to look into it. Eric didn’t just check. He took the idea and ran with it. Within a week, Eric, Karim, and the Paribus team had built a new feature that automatically secured refunds for late shipments, helping thousands of customers save money immediately.

This is a textbook example of what had made Paribus successful: identifying a problem, moving quickly to solve it, and delivering real value to users.

Eric expected praise. Instead, he got pushback. The day after the feature launched, Eric’s direct manager called him into his office. When asked whether he was responsible for shipping the product, Eric proudly said yes, thinking his manager would be thrilled. He wasn’t. Capital One, as a regulated financial institution and public company, had processes for everything.

Rolling out a feature without approvals? That wasn’t how things were done. Moving fast wasn’t celebrated—it was seen as risky. Having this level of scrutiny, may be the right choice on some occasions. But not all.

That’s the importance of understanding your product, your customer and your industry. It will allow you to categorise certain parts of your product into ‘move fast and iterate’ or ‘be careful, release only when fully ready’. That way you’re moving at the individual fastest possible speed for each part of the product. And not resorting to the lowest-common denominator speed.

Which is what most companies do. And which is what happened in our Capital One story.

Another example of a trade-off between speed and quality is “Tech Debt”, referring to the mistakes/poor structure that accumulates as your code becomes more complex while you make shortcuts in developing your tech stack.

Importantly Ramp doesn’t view tech debt as a pure-negative. It’s like regular debt – if the interest rate is low and you are using it to get a larger windfall in the future, you’re using the debt to get to your destination faster. Take the debt, and pay it down as you grow.

Early days, the Ramp team refused to build/design code for 5-10 years into the future because they didn’t know if they would survive another year. Now as Ramp has matured, so has the length of the bets the company can make.

And yes – they’ve had to remake parts of their tech stack. But they made the trade-off with eyes wide open, and were able to plan ahead for the rebuilds. Like financial debt, tech debt only works if you keep track of it.

Speed is hardened into the Ramp culture. When you walk into the Ramp office, you are met with a beautiful screen that shows how old the company is.

Ramp tracks exactly how many days they've existed, doing this makes every day feel urgent. It combines the big vision with daily execution.

So how can you implement this in your own business?

Have a collective company calendar and track the days. By knowing events are constantly going on, by having deadlines to ship things publicly. Your company can rally around and have a clear sense of urgency, whilst understanding the bigger picture.

One way Ramp closes feedback loops and applies this level of speed is through adopting AI to build internal tools. Ramp built a bot called Toby, to which all employees have access to.

Toby is a “know it all” when it comes to anything about Ramp, the company and its products.

No one person has the time to listen to 50,000 sales calls, but an LLM does. So that’s what Toby does, through a custom integration with Gong that allows you within Slack to ask Toby “why do customers pick ramp over competitor X?” during a sales call.

Their time to ship it? 3 days.

You can't hide behind "oh we’ll do it next quarter" when everyone sees the days ticking. Toby is an example of a product shipped quickly that helps people work faster by making knowledge more accessible.

Making the decision making quicker, decreasing the time it takes to iterate on product development sales feedback which all funnel back to better customer service.

Shorten. Your. Feedback. Loops.

"I've never seen a company have faster product velocity" - Logan Bartlett, Redpoint.

If you want a company that moves fast. You have to design and allow for it. From Day 1. All the way until Day 2,200+.

3. How to counter-position your product by studying your competitors

Eric has been going deep into corporate finance, expense-management and business credit-cards for years and years.

In 2014, Eric and Karim started Paribus, designed to save consumers money.

In 2016, the company was acquired by Capital One, where Eric worked until 2019.

Before starting Ramp, Eric spent weeks and months talking to CFO’s and Founders truly trying to understand what problems they cared about.

Then in 2019, Ramp was launched.

That’s over 11 years of industry experience, let alone the countless hours and hours of reading and research Eric did.

Before starting Ramp, Eric Glyman (and Karim Atiyeh) founded Paribus (Acq by Capital One) and worked there for ~2 years.

Eric is a student of the game. A student of his industry.

Big opportunities often hide in problems so simple that smart people and companies overlook them. (and dummies like me miss them too, but hey, that’s expected)

When launching Ramp the focus of their marketing was on:

“Corporate Cards Built to Reduce Churn.

Corporate Cards Built to Reduce Burn.”

That’s beautiful writing, and it’s also talking directly about customers' problems, in language they understand and in the words they use. It’s not corporate BS.

Why is this important?

You need to think deeply about your industry - What are your competitors ignoring? What can you differentiate on? What problems can you solve for your customers? What do they care about?

In 2019:

Capital One specialised in underwriting.

American Express was great at gifting and rewards.

And Brex had great marketing targeted at startups that were growing fast.

But nobody was helping businesses spend less money. Nobody was focused on product and engineering.

This was a $16B (and counting) problem hiding in plain sight.

Find a simple problem. Then take it seriously. And work at it for longer and harder than anyone else would think is reasonable.

Use first-principles thinking to question the status quo and discover simple billion dollar ideas you and your competitors have overlooked.

“Corporate Card Counter-Positioning. Ramp’s early moat comes from counter-positioning against corporate cards designed to make companies spend more.”

Ramp realised that the incentives for card issuers and customers were misaligned. That businesses do not succeed by spending more and that marginal rewards have no long-term material impact on a business's success. (Wow that sentence sounds like a bee buzzing hah)

Instead, driving savings – not spending - will be better for customers and the company in the long run.

This echos the Amazon “Customer Obsession” ethos, Bezos summarizes this point nicely saying:

"What's good for customers is good for shareholders. Take a long-term view and the interests of customers and shareholders align." – Jeff Bezos

At Ramp this means realising that most businesses, finance teams and people building companies are not interested in lounge-access. They’re interested in being profitable, in spending less money, in getting home earlier, in doing more with a smaller team. Ramp understands that great companies are built on enduring principles.

Jeff Bezos said (paraphrasing); That customer desires will always be the same, technologies may change, approaches may change but consumers will always want lower prices, faster delivery and a bigger selection of goods.

That’s the same thinking Ramp uses. No one will say “I just wish I was less efficient with my spending. I wish it took longer to close my books”. People will always want to get the same things for less.

Eric's Reading Recommendations

Thanks for reading! To uncover more startup stories - check out Next Play.